MAGICAL INTEREST REVISITED — BEWARE OF MAGIC

(Investigator 174, 2017 May)

(Investigator 174, 2017 May)

Personal Finance Writer Anthony Keane has criticized the Federal

Government's recent idea of giving people who don't own a house access

to their superannuation money to use as a house deposit.

He calls it a "super-silly idea" because spending one's super now would put a huge "dent" in the future wealth of savers by reducing the effect of "the magic of compound interest".

Keane considers the case of a 20-year-old whose $20,000 in a superannuation fund compounds at 7½ per cent yearly. In 50 years he will have $841,000!

Wow! Who wouldn't want to have $841,000!

He calls it a "super-silly idea" because spending one's super now would put a huge "dent" in the future wealth of savers by reducing the effect of "the magic of compound interest".

Keane considers the case of a 20-year-old whose $20,000 in a superannuation fund compounds at 7½ per cent yearly. In 50 years he will have $841,000!

Wow! Who wouldn't want to have $841,000!

ANOTHER MAGIC

Previous comments about "Magical Interest" were published in Investigator Magazine #39 and #40.

The problem with magical interest is that it might be thwarted by an opposing magic called "inflation".

Let me get personal here and share my experience. It covers a similar period as Mr Keane's example — i.e. almost fifty years.

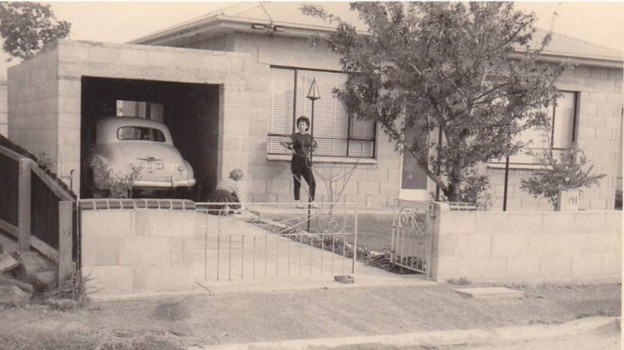

In 1969 my mother remarried and sold her house. I argued: "Keep the house and rent it out; that way we won't lose even if Australia experienced rapid inflation." My mother ignored the possibility of inflation and said it's easier to let her money grow in the bank. Then, if her new marriage were to fail she would have more money and can purchase a better house than the one sold.

Six years passed and the oil crisis that began in 1973 changed finances and values of assets worldwide.

The $5000 from the 1969 house-sale compounded to about $7000 in 1975.

Some people might consider this to be "magical" except for the fact

that the price of an equivalent house had increased to $18,000. Today

the same property is worth about $350,000.

My mother never did buy her better house. But she learned her lesson and invested in properties. One vacant block of land she purchased for $6000 in 1982 sold for $12,000 in 1984. Another purchased in 1990 for $5000 sold for $55,000 in 2008.

My mother never did buy her better house. But she learned her lesson and invested in properties. One vacant block of land she purchased for $6000 in 1982 sold for $12,000 in 1984. Another purchased in 1990 for $5000 sold for $55,000 in 2008.

BEWARE

The above comments do not constitute advice to invest in property as that could go wrong too. You've probably, for example, seen news footage of houses collapsing into the ocean or down a sinkhole — events that insurance may not cover! The point I'm making is that we cannot control the future and things sometimes go wrong quickly — much more quickly than 50 years!

We do not even know what level future inflation will reach. What if in 50 years the $841,000 postulated by Keane as a magical jackpot happens to be the price of a loaf of bread? That would be a disappointing result, and more so if one paid rent for 50 years in preference to buying a house.

Also affected by inflation, besides superannuation, are investments of cash. These may attract establishment fees, commission, maintenance fees, financial adviser fees, government charges, and taxation. Sometimes fees together with inflation can dent the value of investments severely.

Don't put all your trust in magic but consider your options carefully. Beware.

REFERENCES:

Keane, A. Home ownership scheme simply a super-silly idea, Sunday Mail 2017, March 19, page 72

Magical Interest, Investigator Magazine #39, pp 9-11; #40, pp 4-5.

(BS)

Over 2000

articles from Investigator Magazine: